Salman Ahmed Shaikh

Labor is an important factor of production in any production process. In classical literature, labor theory of value appears as a fundamental determinant of commodity price movements.

In the middle of the Industrial Revolution, Marx observed the exploitation of labor by capitalists. In his study of the production process, Marx argued that all value is created in the production process and by the labor effort while the capitalist extracts the surplus value in the exchange process. As a result, he advocated the denial of private ownership of means of production so that labor could not be exploited by the capitalists.

Nevertheless, due to coordination and incentive problems, the radical policy suggested by Marx could not be fully implemented and wherever it was implemented to a smaller or larger extent, it was eventually abandoned.

The alternative mainstream neoclassical perspective rests on the market mechanism, in which economic agents make self-centric economic choices based on marginal valuations of costs and benefits. Hence, the mainstream economics literature since the second half of the twentieth century has focused more on economic choices by households to decide how much time should be allocated between leisure and labor supply.

In addition, the mainstream literature also focuses on labor market dynamics, agency conflicts, insider–outsider relationships, industrial organization, and other frictions that hinder market clearing in the labor market and result in persistent unemployment.

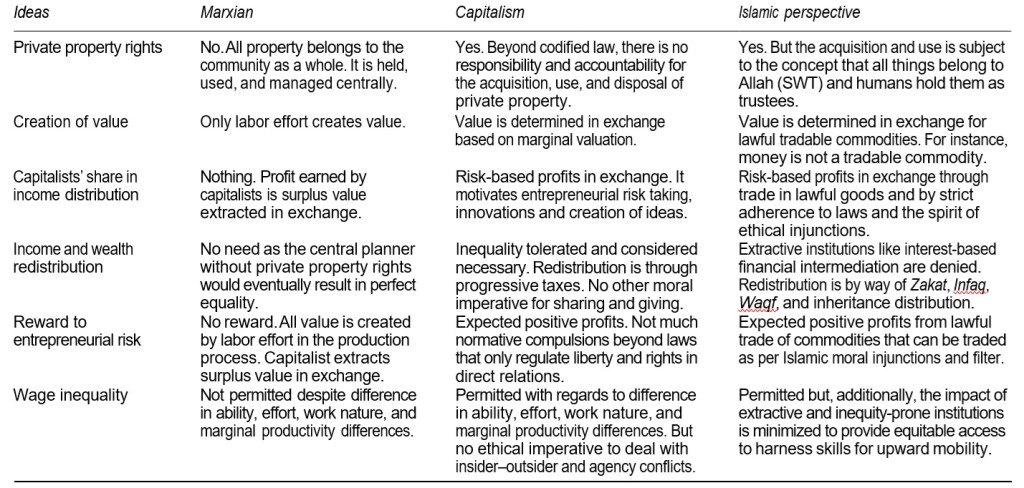

From an Islamic perspective, we do not fundamentally need to try to suggest a new positivist explanation of labor as a factor and explain labor market dynamics. However, it is vital to find the right balance between the two standard economic perspectives and to suggest ways to overcome coordination and incentive failure (as in Marxism) and to avoid labor exploitation and systemic inequalities in income distribution between capitalists and labor (as in capitalist economics).

A Critique of the Marxian View of Labor

In Marxian economics, it is argued that labor creates surplus value in the production process that capitalists extract in the exchange process. Marx said that the capitalist purchases the use value of labor (service) and pays labor something equivalent to the exchange value of labor time. It is barely enough to keep the labor survive. However, when the capitalist sells products created by “labor power,” these products command more exchange value and this excess is known as surplus value. The surplus accumulates and this is exploitation of labor by the capitalists.

However, upon closer inquiry, it is clear that the payoffs to labor and capitalists are different in the production process. Labor gets a fixed wage, whereas the capitalists earn variable profits from the sale of a good or service in the exchange process. Labor gets a fixed wage irrespective of profit to the capitalists, which could be negative.

It was rare for losses to occur at the height of the Industrial Revolution, but that does not suggest that profits are the necessary outcome of every production process for the capitalists. Capitalists compete among themselves and their competition in theory may in the long run bring prices down to the level of marginal cost in competitive markets. If there is allocative efficiency in the market, then the producer price is only as much as the cost of production, which only includes the normal profit for the entrepreneur.

Furthermore, in the countries where labor was exploited during the Industrial Revolution, per capita incomes have increased manifold. We know by experience and data that most new startup firms fail and not all capitalists are always able to reap value greater than labor from the production process. Hence, capitalists take the risk of uncertain profits, prices, and sales fluctuations and they must have an incentive to take the risk. The incentive is in the ability to make profit from the sale of products. But profits can be negative as well. As long as they are earning profits from the sale of goods (with intrinsic value) sold to willing buyers at competitively set market prices, Islam does not regard it as exploitation.

Further, social relations are no longer mutually exclusive. Employee stock ownership plans, general and limited partnerships, and joint stock companies have modified actor relations. In a joint stock company, there is no one big capitalist. There are small shareholders in large numbers who are workers in other organizations. Nowadays, scientists, programmers, and artists can have patents.

As per Marx, labor has only one thing which he can use to earn income: labor power. However, why does the laborer not become a capitalist? It can be said that the lack of seed capital acts as a constraint. But, in most developed countries, there are fewer constraints on borrowing. Then why do the majority of people not become entrepreneurs by choice? If the working class is always greater in number than the capitalists, then why do most democracies not overthrow the market system?

The fact of the matter is that markets create incentives and encourage competition, and that allows capital accumulation, technological change, economic growth, and the transaction of a wide range of goods as well as services.

According to the Islamic perspective, there is no harm if people specialize and engage in the voluntary trade of goods in a legal and ethical way. Islam does not recommend an arbitrary equal distribution of income for all people with diverse work efforts and skills. The promise in communism of equal wages and standards of living is very attractive at face value, especially to the masses, who generally do not have highly employable and demanded skills, access to quality education, and opportunistic circumstances.

The argument that each person as a human being should have equal rights and an equal standard of living seems convincing. However, it is a fact that people have different tolerances for risk, different innate abilities, different attitudes toward progression in life and career, and different levels of ambitions; as a result, they exert different levels of effort in acquiring education and skillsets and so their productivity levels are different. The difference in characteristics highlighted above may not necessarily be a result of discrimination or exploitation. Most of these could be controlled and determined by individuals and by their intertemporal choices. Equating everyone’s compensation despite these factors would be unjustified.

Labor in Neoclassical Theory

In classical economics, the labor theory of value was used as a framework to explain why the prices of some goods were higher than others. If the production of a commodity requires more labor effort, the price of such commodities will be higher than other commodities that require fewer labor hours to be produced.

This theory remained in vogue in the pre-Industrial Revolution era and Muslim thinkers like Ibn Khuldun explained it in their works long before Smith, Ricardo, and Marx used it to explain the production processes and determination of prices. Later on, this theory was replaced by marginal value and the marginal cost principle as a foundation for demand and supply behavior in the marketplace.

Another stream of literature in labor economics focuses on the labor market itself and how wages are determined in the labor market. Frictionless labor market equilibrium is a simple and useful framework to analyze comparative static results of supply shocks and technological advancement on equilibrium wage and employment. However, the frictionless model is not able to explain the presence of unemployment and vacancies at the same time. Search models tried to fill the gap by adding frictions in the model to incorporate the empirical realities of the labor markets.

Peter Diamond, Dale Mortensen, and Christopher Pissarides are some of the prominent contributors in this strand of literature. Diamond along with Mortensen and Pissarides explain wage determination in search models and how jobs are destroyed and created with frictions. This brand of literature is focused on a positive explanation of the empirical realities of labor market dynamics.

Another brand of literature in labor economics has tried to explain labor market rigidity, especially wage rigidity, to explain short-run business cycle fluctuations. The wage rigidity is explained on the basis of differential work effort by labor and the tendency of firms to pay above market clearing wages, i.e. efficiency wages to retain the talent pool and reduce the tendency toward labor shirking. New Keynesian and other economists have also focused on industrial organization and bring labor unions into the models to explain how insider–outsider relationships also result in wage rigidity.

Yet another stream of literature has focused on explaining the micro foundations of labor supply and labor demand. To explain labor supply decisions at the micro level, mainstream microeconomic theory uses the consumption/leisure framework to explain the allocation of time between leisure and working. Using this framework as a foundation, later studies have tried to explain the labor supply dynamics of, for example, immigrants, women, and minorities.

While the provision of property rights and self-centric choices is a better alternative to over- come coordination and incentive problems in the Marxian framework, the capitalistic economy has been unable to check extractive institutions which create systemic inequalities between capitalists and labor in income distribution.

There are two reasons why wealth inequality may still persist in a capitalist society: (i) interest-bearing capital accumulation and (ii) incapacitated wealth redistribution mechanisms. Both the absence of broad-based wealth taxes and the legal decree of allowing compound interest on money capital are the prime sources of wealth concentration in a market economy. Das Capital, Volume III, Chapter 24 starts with this statement: “The relations of capital assume their most externalized and most fetish-like form in interest-bearing capital.”

The disincentive to enter into entrepreneurial pursuits because of a lack of willingness on the part of capitalists to put capital at risk while having the opportunity to earn fixed interest income reduces investment in the economy. A decline in the potential investment in productive pursuits reduces real sector economic growth, raises unemployment, and adds burden on governments’ fiscal positions to expend on transfer payments. Then, if more money is printed, it increases national debt, which can eventually result in a country paying a major portion of its gross national income every year in the form of interest.

In an Islamic economy, the principle of making without leaving the long-term planner in the private sector to worry about fiscal policy reversals.

Labor from an Islamic perspective

The key difference in an Islamic framework comes in regards to moral injunctions such as filter and ethical checks on defining various legal and moral imperatives on the economic behavior of both capitalists and labor.

Islam removes the extractive institutions that perpetuate income and wealth inequality in an economy, especially the institution of interest and the freedom to devise tax policy for elite interest groups in capitalist democracies that put the welfare of future generations in jeopardy by excessive deficit financing and inflation tax.

In an Islamic economy, the principle of “risk-based productive enterprise” and “interest- free financial intermediation” can result in growth that is inclusive and not hierarchical in its distributional effects.

The principle of risk-based productive enterprise can foster capital formation and entrepreneurship in an Islamic economy, disallowing fixed returns on money capital in the form of interest. Increases in investment through entrepreneurial activities will increase labor demand and wages. Increases in wages will improve the standards of living of the poor working class and enable them to improve their productivity further. Productivity may also rise with the increase in capital per worker.

Categories: Articles on Islamic Economics